Introduction to the credit rating system

In general, we can divide all credit ratings (and that applies to Moody’s credit rating as well) into two major categories:

- Investment-grade, and

- Non-investment grade.

Non-investment grade bonds are also called junk-bonds or high-yield bonds.

Investment and junk bonds

Investment-grade bonds are further divided into the following categories:

- Prime,

- High grade,

- Upper medium, and

- Lower medium grades.

We divide Non-investment grade bonds (aka junk bonds) into the following categories:

- Speculative,

- Highly speculative,

- Substantial risks,

- Extremely speculative,

- Imminent default, and

- Defaulted.

Credit rating agency specifics

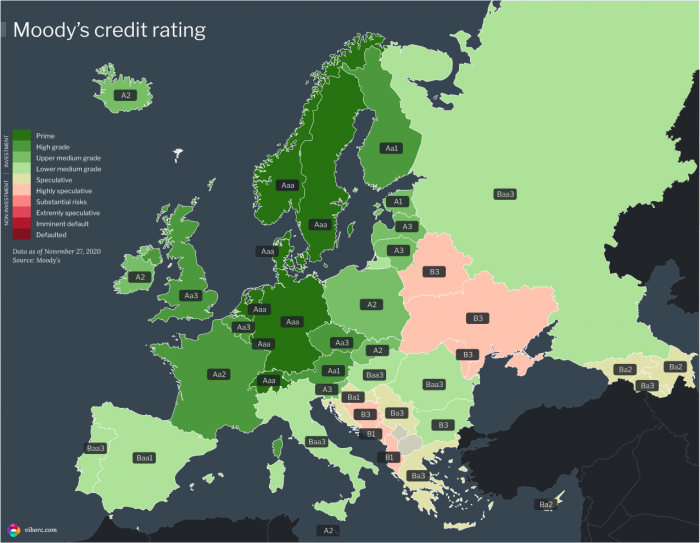

Different rating agencies then use their specific ratings fitting into the categories mentioned before. For example, in Moody’s credit rating system – their Aaa rating corresponds to Prime, while Ba1 would fit (together with Ba2 and Ba3) into the Speculative category.

The map of Europe with Moody’s credit ratings in 2020

To simplify this entire categorization and to put different European countries in context, I created this map of Moody’s credit ratings for 2020 for European countries. Clicking on the map will open a map in higher resolution.

Interactive map of Europe with credit ratings

And if the map is not enough – I also created an interactive visualization where you can move your mouse over different countries and see their credit ratings.

Also, the interactive part comes with a tabular overview of every bond rating type and category. If you need to get the credit rating data in CSV format, as a free and open dataset, check out the instructions in the next paragraph.

Get the data

If you are looking to get the same data used for the maps above, feel free to take it from viborc.com GitHub repo here. In essence, there is a CSV file with Moody’s credit ratings for all European countries.

ABOUT THE AUTHOR